THE WORLD’S MOST AFFORDABLE PROPERTY MARKET: WHY 2026 BELONGS TO SOUTH AFRICAN INVESTORS

As we prepare to step into 2026, many South Africans are feeling the weight of a sluggish economy, muted GDP growth, and ongoing fiscal pressure. Headlines paint a challenging picture. But the data—and the reality for strategic property investors—tell a very different story.

Despite economic uncertainty, South Africa is entering one of the strongest high-yield property cycles in more than a decade, especially for investors who embrace alternative strategies such as multi-lets, student accommodation, short-term rentals, and low-cost housing.

Watch our YouTube video, Property Investing 101: From Zero to Financial Freedom in South Africa.

At Prosperity Enterprises, our clients are consistently achieving:

- 20%+ gross rental yields

- 15%+ net yields

- High occupancy

- Strong long-term capital growth

In a world where most markets are facing declining yields and affordability crises, South Africa stands out as a rare opportunity.

1. The Economy Is Slow… but the Property Market Is Not

GDP growth is subdued, and economic pressure remains—but inflation has stabilised, and the interest rate cycle is finally turning.

Property Price Growth Is Quietly Strengthening

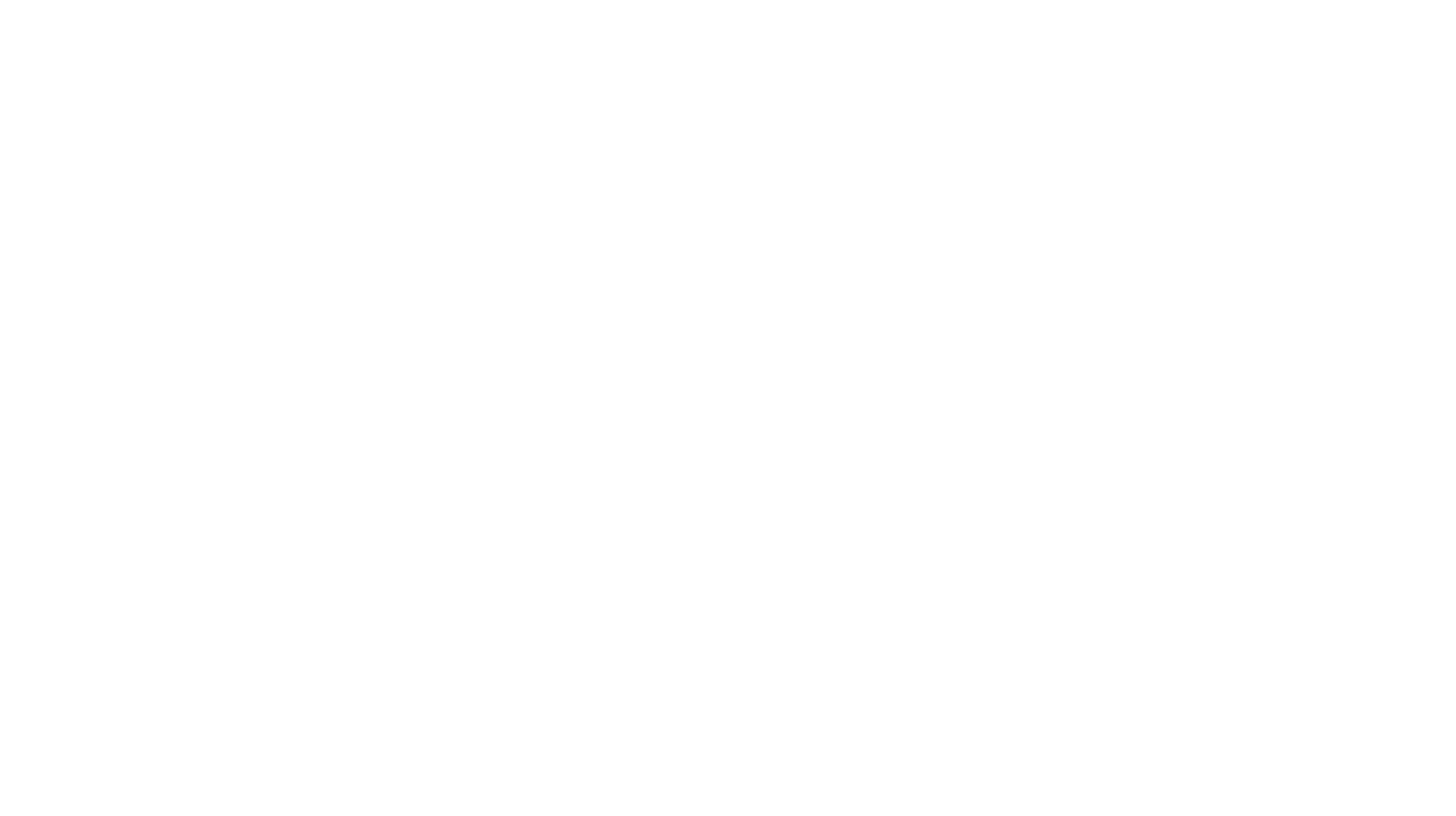

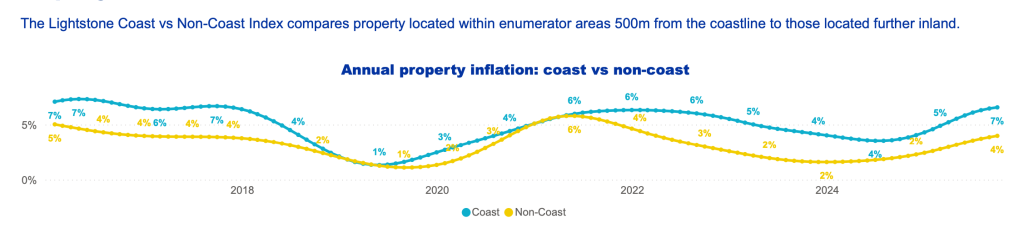

Lightstone’s latest Residential Property Indices (Sept 2025) show:

- National annual house inflation: 4.2%

- Coastal areas: 6.6%

- Non-coastal: 4.0%

- Low-value properties (< R500k): 9.8% annual growth

These numbers are crucial because the strongest growth is happening in the most affordable segments, where alternative strategies thrive.

2. Rental Demand Is Surging Across the Country

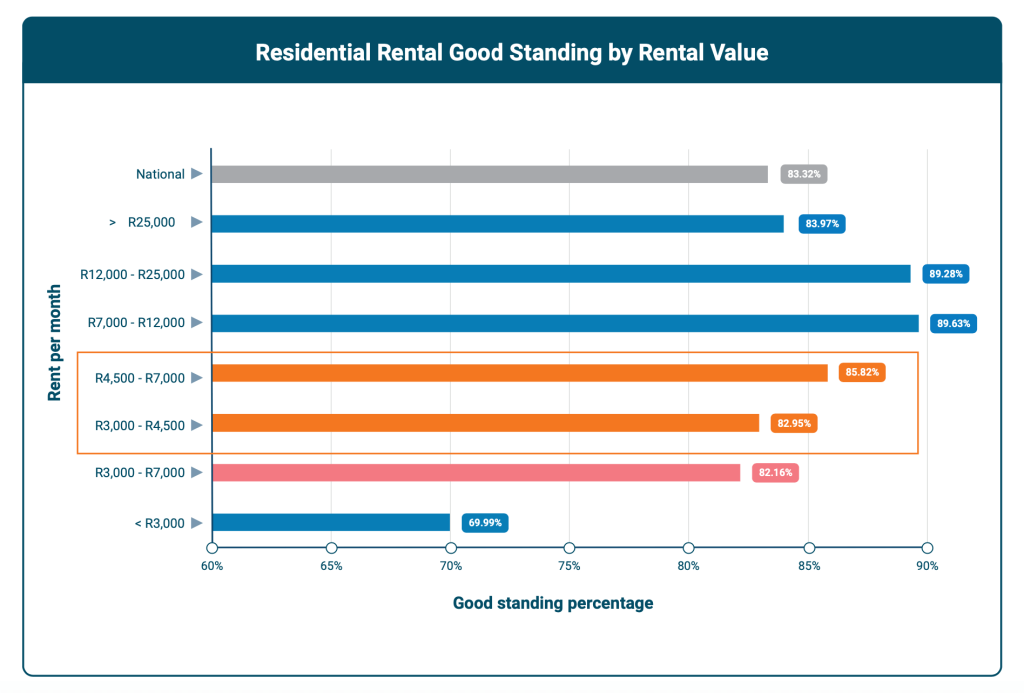

TPN’s Q1 2025 Rental Monitor highlights an incredibly resilient rental market:

- 83.32% of tenants are in good standing nationally

- The R7,000–R12,000 rental band now represents 30%+ of the market

Homeownership continues to fall—only 6.3% of households are paying off a bond

The decline in homeownership is structural, not temporary. Rising living costs, high debt levels, and financial uncertainty mean more households are renting for longer, pushing rental demand to new highs.

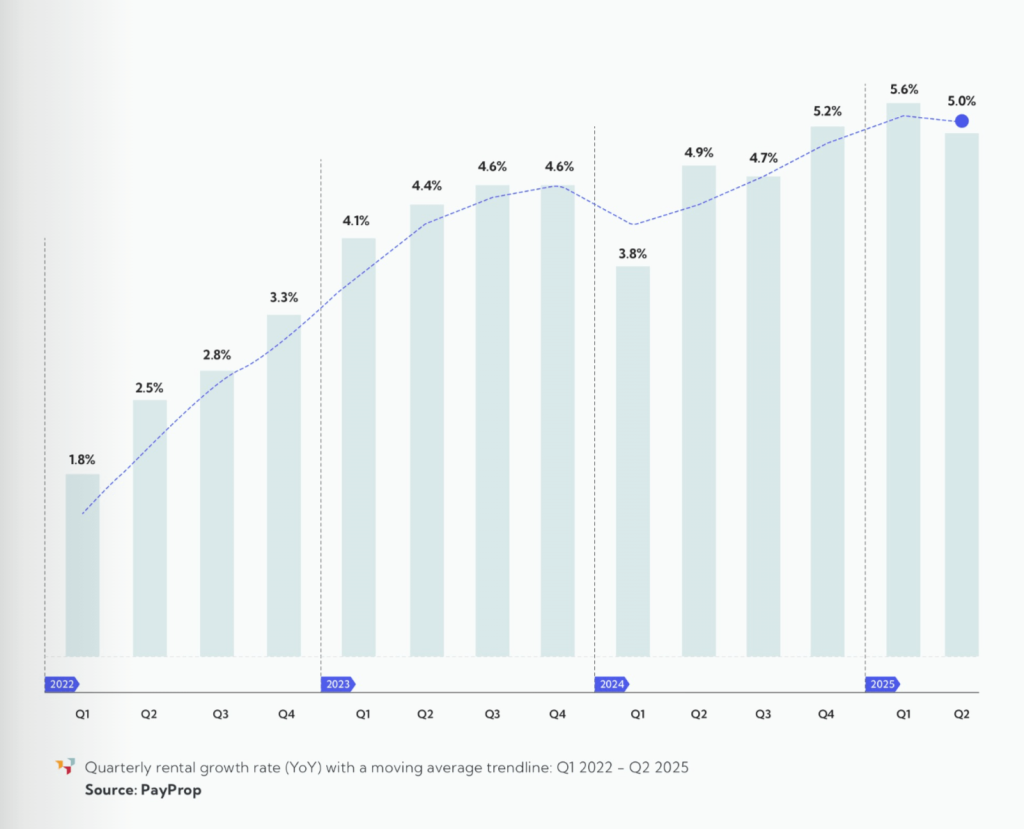

3. Rental Growth Is Outpacing Inflation

TPN data shows national rental escalation at 4.49% in Q1 2025, with certain brackets performing even better:

- Below R3,000: 4.36%

- R3,000–R7,000: 3.95%

- R7,000–R12,000: 5.12%

- Above R12,000: 5.68%

This is well above CPI and confirms that rental property continues to beat inflation, especially in areas ideal for alternative strategies.

4. South African Property Is Shockingly Affordable Compared to the Rest of the World

While global markets grapple with a severe housing affordability crisis, South Africa sits in a uniquely favourable position.

South Africa Is the Most Affordable Housing Market on Earth

A global affordability study released in 2025 found that:

- South Africa ranks #1 in the world for housing affordability

- Home prices exceed average wages by only 6.22%

In contrast:

- Countries like Turkey exceed 80%

- Many European markets face affordability ratios that make homeownership nearly unattainable

Global databases such as Numbeo reinforce this:

- South Africa’s price-to-income ratio: ±3.2

- Prime foreign markets like Monaco: 40+

This means property here is not just affordable—it is undervalued relative to global norms.

Pair that with:

- Strong rental escalations (4%–6%)

- High tenant demand

- Low supply of affordable stock

- Capital growth of 4%–10%, depending on segment

…and you get one of the best investment landscapes in the world.

A Once-in-a-Decade Window

South Africa offers a rare alignment:

1. Globally cheap purchase prices

2. Strong, rising rental income

3. High yields from alternative strategies

4. Growing demand and limited supply

5. Capital growth accelerating in key segments

This combination never lasts forever. As affordability becomes recognised globally, international capital, semigration trends, and local investors will drive prices upward—compressing yields.

The window is now.

5. Why We Are Achieving 20%+ Gross Yields in a “Weak” Market

Because we don’t invest traditionally.

Multi-Lets

Convert one property into multiple rentable rooms or units.

- Higher rental per m²

- Lower vacancy

- Strong demand

18%–24% gross yield

Read our article, Building Wealth Through Multi-Lets: A Smarter Property Strategy For South Africans.

Student Accommodation

Stable, recession-proof, consistent.

20%–28% gross yield

Short-Term Rentals

Especially strong in semigration and travel hubs.

15%–25% gross yield

Low-Cost Housing

Backed by the strongest property inflation in the country (9.8%).

16%–22% gross yield

With proper structuring and management, clients consistently achieve 15% net yield, even after expenses.

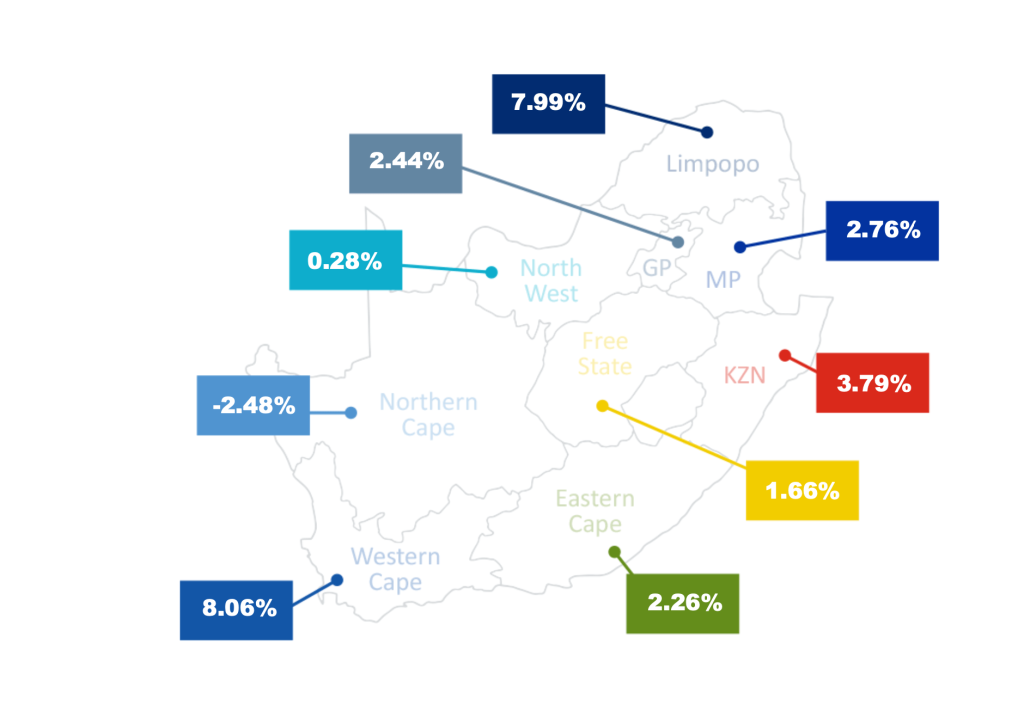

6. Provincial and Metro Insights for 2026

Lightstone’s provincial data (Sept 2025) shows:

- Western Cape: 8.06% inflation

- Limpopo: 7.88%

- Gauteng: 2.44%

Municipalities:

- Cape Town leads major metros at 7.6% inflation

- Johannesburg stabilising at 1.7%

- Tshwane and Ekurhuleni showing renewed strength

TPN reveals:

- Western Cape tenants: 89.10% in good standing

- Gauteng: 82.21%

- KZN: 76.92%

This all points to excellent yield opportunities in Gauteng and inland provinces—and high capital growth in coastal and semigration hubs.

7. Rising Construction Costs Are Increasing the Value of Existing Stock

Materials, labour, and compliance costs continue to rise faster than inflation.

This raises:

- Replacement costs

- Resale values

- Rental prices

It also makes conversions and repositioning strategies (multi-lets, student housing) far cheaper and more profitable than building new stock.

8. Why 2026 Could Be Your Most Profitable Property Investment Year Yet

✔ Interest rates are expected to drop further

This improves affordability and enhances cash flow.

✔ Rental demand is climbing

South Africans are renting for longer, and rental bands continue to shift upward.

✔ Affordable stock is outperforming

The under-R1 million market shows the strongest inflation and rental growth.

✔ Alternative strategies continue to out-yield traditional rentals

Student housing, multi-lets, and low-cost rentals are outperforming national averages dramatically.

✔ South African property is globally undervalued

This makes 2026 a rare entry point for long-term investors.

Final Word: Don’t Wait for the Perfect Moment—Buy the Right Property Now

The economy may be slow, but the fundamentals driving rental property are the strongest they’ve been in years:

- Demand

- Affordability

- Yield

- Replacement cost

- Tenant behaviour

- Capital growth

Combine that with the fact that South Africa currently offers the most affordable property market in the world, and you have a once-in-a-decade opportunity.

In a world of volatility, property remains one of the most reliable, inflation-beating, wealth-building vehicles—especially when you use the right strategy.

View the recording of our recent webinar, Property Investment Trends and Analyses.

Don’t wait to buy property.

Buy property—and wait.

Read the entire article in the December 2025/January 2026 Edition of Real Estate Investor Magazine.